“Compound Interest is the greatest mathematical discovery of all time.” – Albert Einstein

Like normal young people starting out in their first full time job, many find it difficult to save, wanting to buy the latest technology, exploring the world or eating too many avocados on toast! Having recently graduated from University and being in my first full time job, I can appreciate how difficult saving is. However, by saving early everyone can benefit from compounding returns.

Compounding return is the rate of return that represents the cumulative effect that a series of gains or losses has on the original capital invested over a period of time. In simpler terms, when you invest money you earn a return on your capital. The next year you earn a return on both your original capital and the return from the first year. This continues until you start to take capital away from your investments.

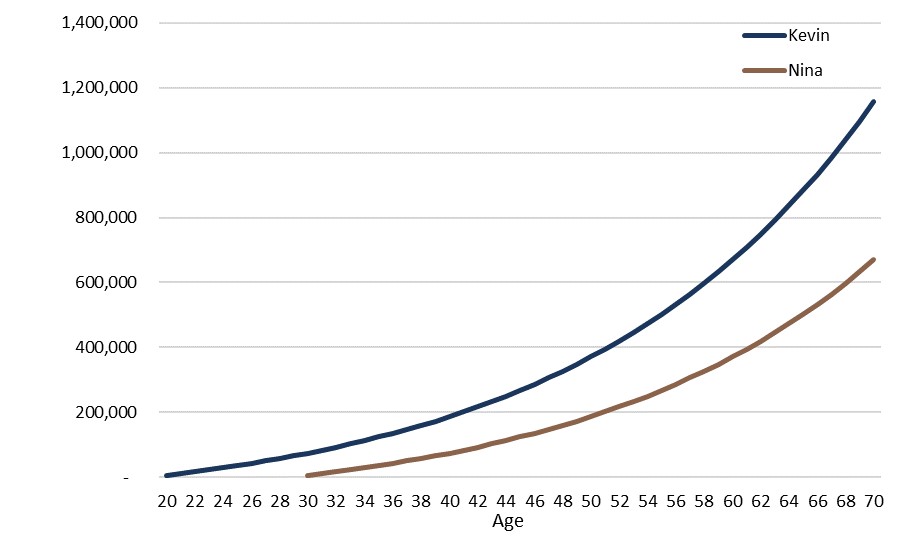

There are two things required to benefit from compounding returns, reinvestment of earnings and time. The earlier you start investing, the more time you leave for compounding returns to take effect. For example, Kevin and Nina both save £5,000 per year but Kevin started saving at 20 and Nina started saving at 30.

*This is based on a compound return of 5% per annum

As you can see, Kevin’s saving pot is significantly more compared to Nina. Whilst only contributing an extra £50,000, there is almost £490,000 more in Kevin’s savings pot compared to Nina’s. Now, I wonder which saving pot you would prefer?

The above chart demonstrates the importance of time in the market, not timing the market. In 1987, if you invested £1,000 in the FTSE All Share and left your investment alone, it would be £13,320. Whereas, if you missed the best 10 days, your investment would be worth £7,124 and £3,168 if you missed the best 50 days[1].

In a more recent event and as we all experienced in the December 2018, market sentiment can change quickly. If Kevin was invested in the FTSE All Share on the 3rd December and sold all his holding on the 27th December, he would have crystallised a loss. However, if Kevin had simply held onto this holding and sold today, he would have made a positive return on his investment.

Remember, saving is not everything. But like most things in life, it is important to get the correct balance. With investing it is the balance between enjoying yourself now and providing for your future and retirement- after all, retirement is where the true exploring starts!

[1] David Brett Schroders, ‘The ‘£17,808 cost’ of mistiming your investments’Remember, saving is not everything. But like most things in life, it is important to get the correct balance. With investing it is the balance between enjoying yourself now and providing for your future and retirement- after all, retirement is where the true exploring starts!